Knowing how they work and the method to decrease them is essential to sustaining a healthy financial plan. Brokerage fee expenses range depending on the broker you select — a full-service broker or a discount dealer. Some generous employers pay the fees on behalf of plan members, which suggests you’re only liable for the investment bills. However if your plan is pricey and the investment selection is slim, you’ll have the ability to minimize charges by contributing just sufficient to earn your employer’s matching dollars. If you’re in a place to max that out for the yr, you’ll have the ability to return to the 401(k) to continue contributions. Some brokerages will supply to reimburse transfer charges incurred by new clients.

B Account Upkeep Fees

This is usually split between the vendor’s agent and the customer’s agent. Some low cost actual property brokerages could charge a decrease price or even offer a fixed-fee service. Charges for money administration have additionally been compressed via robo-advisors, which use algorithms to mechanically establish and maintain an optimum funding portfolio. These providers charge far lower than a human advisor, generally between 0.20% and 0.30% per 12 months based mostly on property held.

Familiarity with these costs empowers traders to navigate the financial panorama more effectively. Another cause is that the expense ratio may actually be lower than the management charge. That’s because some mutual funds will waive a portion of their fees. They may implement a fee waiver to compete for the dollars of fee-wary investors. Or they might do so as a approach to maintain onto investors after the fund has underperformed.

Are you able to forego entry to various buying and selling tools, assets, and efficient customer support simply to save tons of a few bucks? If not, consider working with brokers providing barely higher fees backed up by a variety of useful companies. Finding a balance between charges and providers https://www.xcritical.com/ offered by the broker might be difficult at occasions, as brokers with the lowest charges appear appealing. They not solely allow you to scale back bills but additionally help protect a significant portion of your earnings from being eaten away.

Usually, you presumably can anticipate to pay about 1% for an funding management charge. The price of investment charges varies extensively, relying on the sort of payment. Advisory charges what are brokerage fees of greater than 1% may be thought of too high a value for many traders. Sales costs sometimes vary between 3% and 6%, so something greater than that could be something to avoid.

It may be the quarterly deduction made by a monetary advisor, or the buying and selling prices and account charges of an online brokerage account, or the regularly deducted administration charges of a mutual fund. Investors with vital assets may get perks like decreased fee rates and decrease administrative charges. They may access unique investment alternatives and premium options. Bigger accounts are more profitable for brokers, particularly those who present wealth management services. Some companies would possibly waive fees, like annual maintenance or platform fees, for high-net-worth purchasers.

Most on-line investing platforms nowadays provide zero-commission buying and selling. But buying and selling with the help of knowledgeable comes at a value, usually as a flat fee or percentage of your funds. Charles Schwab, for instance, charges a $25 service charge for broker-assisted trading whereas Fidelity Investments expenses between 0.50% and 1.50% for wealth management with an advisor.

Widespread Kinds Of Investment Fees

The commonplace fee for full-service brokers today is between 1% to 2% of a client’s managed assets. For example, if a client has a $500,000 portfolio, they can expect to pay their dealer $5,000 to $10,000 yearly. In the insurance trade, a broker, not like an agent, represents the pursuits of the shopper somewhat than the insurer. Brokers help clients find the most effective insurance insurance policies to satisfy their wants and cost charges for their companies. In uncommon instances, brokers could collect fees from both the insurer and the individual shopping for the insurance coverage policy.

- While practically all M&A advisors cost a success charge or fee when your deal closes, some additionally require additional charges.

- Charges and commissions range widely relying on the kind of transaction and the kind of broker.

- Throughout this price warfare, it’s now commonplace to find promises of ‘zero fees’ and different tempting offers.

In addition to administration charges, a mutual fund could cost different annualized charges. Those can include the fund’s promoting and promotion expense, often known as the 12b-1 charge. But when added to the administration fee, it could make a fund more expensive than at first look. While some investing fees Proof of work and bills could appear small, over time they can make an impression on your funding and may have an effect on the value of your portfolio. As an investor, it’s important to remember of these charges and understand exactly what you’re being charged to help make certain you’re getting a good return on investment.

We don’t present investment recommendation or solicitation of any kind to buy or sell any investment products. Buying And Selling carries a excessive stage of danger and is most likely not appropriate for all buyers. Trading monetary merchandise carries a excessive danger to your capital, significantly when partaking in leveraged transactions similar to CFDs. It is important to note that between 74-89% of retail investors lose cash when buying and selling CFDs. These merchandise will not be appropriate for everybody, and it is essential that you absolutely comprehend the dangers concerned.

For occasion, comparing stockbrokers and their charge constructions can help you find a supplier with decrease account upkeep charges and competitive buying and selling commissions. You can optimize your fee structure by researching and selecting a brokerage that aligns with your investment wants. In fact, with many on-line trading platforms providing zero-commission trades, you possibly can slim your analysis to those who cost few or no upkeep charges and require no account minimal.

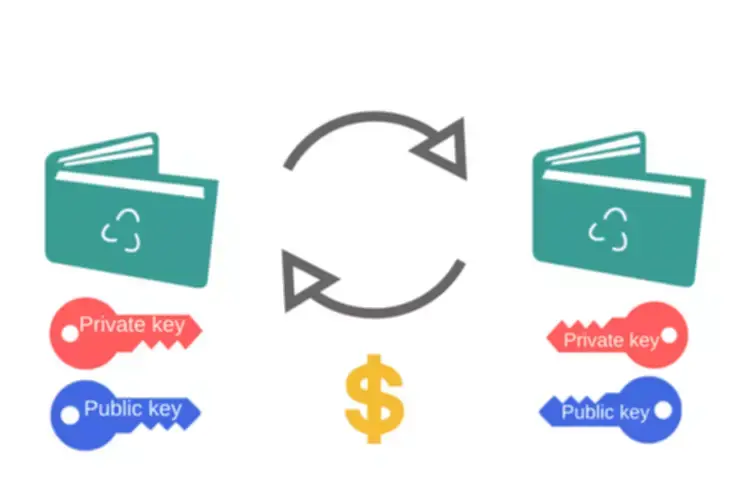

Brokerage fees are any commissions or charges that your dealer costs you. Additionally called dealer charges, they’re usually charged should you purchase or promote shares and different investments, or complete any negotiations or supply orders. Many monetary advisors are fee-only, which usually means they charge a proportion of assets under administration, a flat or hourly fee, or a retainer. Others cost a share of belongings beneath administration and earn a commission from the sale of particular investments.

A dealer may also cost anywhere from a couple of dollars to $30 for analysis. Again, not all brokers levy this cost, so select a dealer that doesn’t cost for analysis. Elizabeth joined GOBankingRates in 2022, bringing together with her a background in each non-fiction and fiction editorial work. Her experience consists of an internship at Penn State College Press during her university years, the place she worked on historical non-fiction manuscripts.